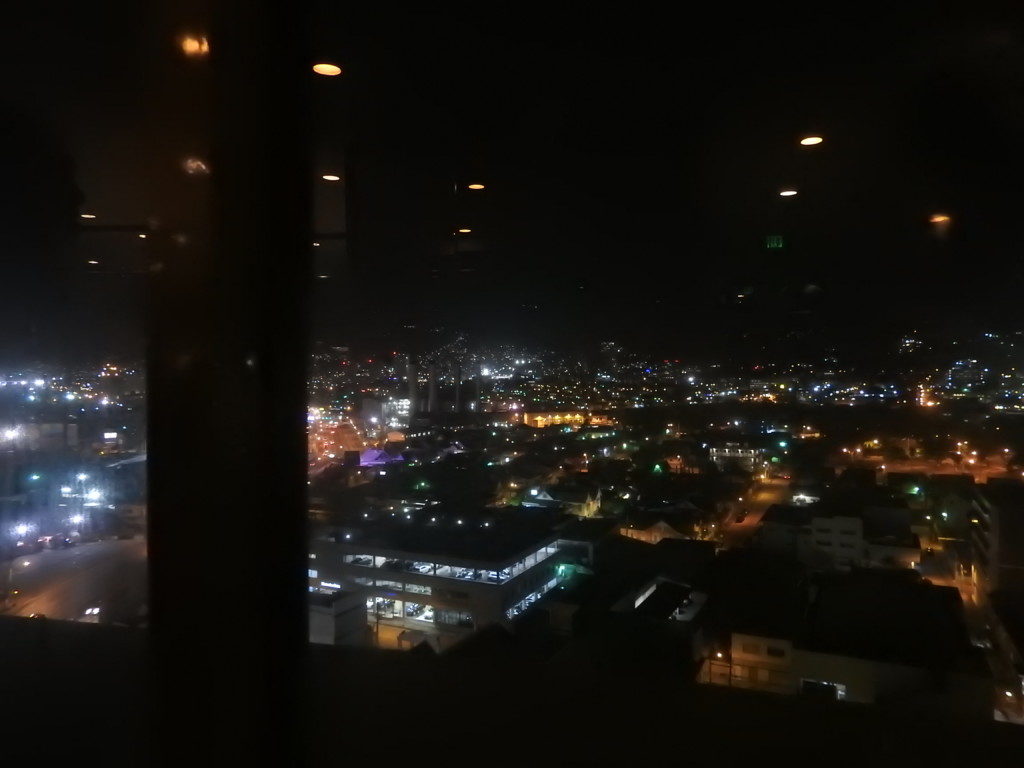

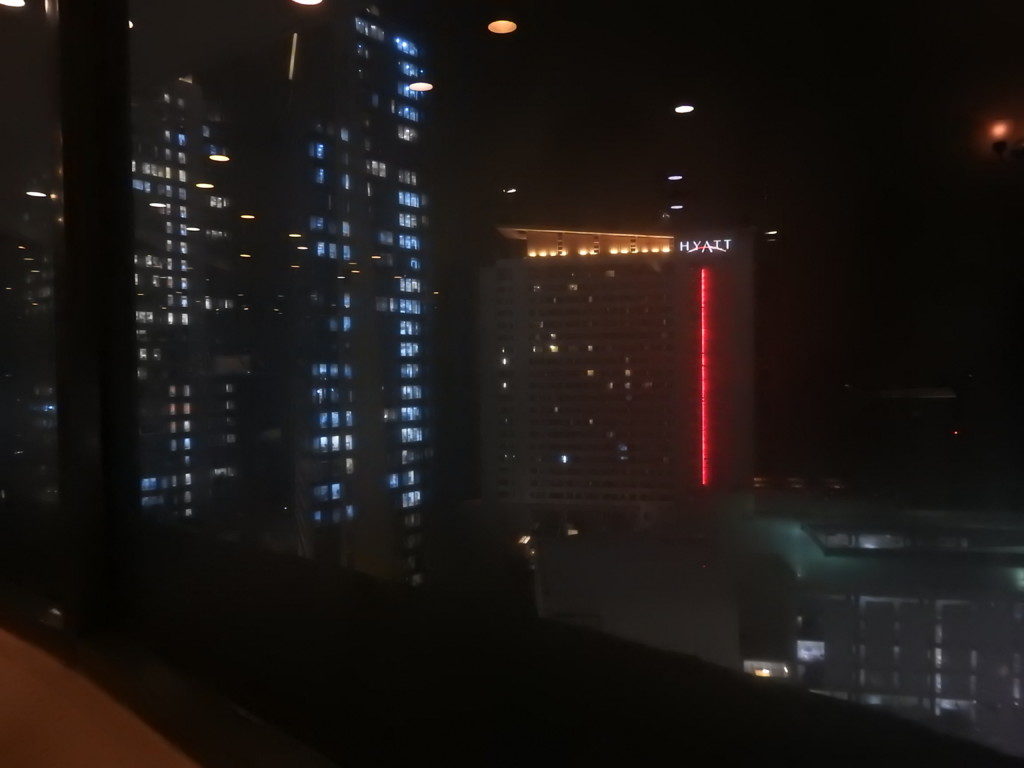

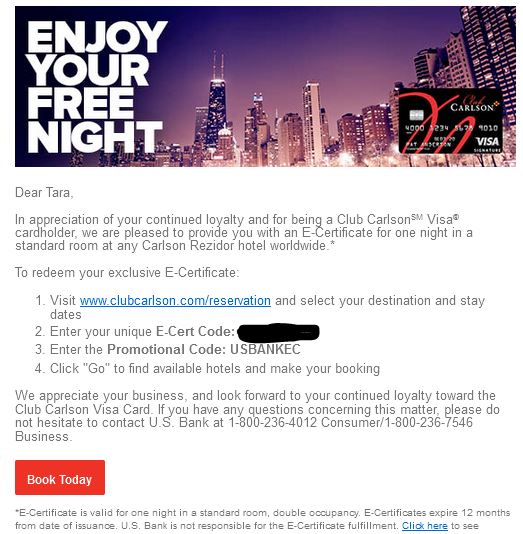

If you saw yesterday’s post about the Radisson Blu in Port Elizabeth, you got a general idea of how having the right credit card can save you lots of money on accomodation. Mainstream travelers who mostly visit cities have a huge advantage over eco-tourists because they tend to stay in one city for a couple days at least. Maximizing the Club Carlson Visa assumes you want to stay in one hotel for at least 2 days. There are a few places around the world where there are good birding sites within a short drive of a Club Carlson property so you can take advantage of the freebies and not waste your time in a city when you would rather be in a rainforest lodge. The example of Port Elizabeth with the day trip to Birds of Eden is one such example, Panama City is another and I really saved a bundle in Tahiti when we had to wait 2 days for the next flight to Rimatara to see the beautiful Rimatara Lorikeets. We also made good use of the “get one night free” during our travels in Israel & Europe before we went to Tenerife for the World Parrot Conference at Loro Parque.

.

WHY DID I HAVE ALL THESE HOTEL POINTS ANYWAY?

Although I am by nature a “free agent” and prefer to choose hotels by location and convenience, not because of loyalty to one chain; between 2009-2011 I found myself a member of just about every hotel program in the book. Why? Because I wanted “hits” in the US Airways Grand Slam promo. This was the cheapest way to get a large number of miles with very little extra cost over what I would normally pay for something. I did direct a lot of our discretionary stays to these programs to get these “hits”.

Fast forward to 2012. Everyone in the miles & points community was expecting Grand Slam to happen again in the usual time of Sept-Nov. We painstakingly did surveys, played Facebook games and did Foursquare “check-ins” to get free hotel points. Well guess what? 2012 came and went and no Grand Slam. 2013 came and went, still no Grand Slam. And now US and AA are merging so there won’t ever be a Grand Slam again. I had all these hotel points and had to do something with them.

Since we usually stay in small eco-lodges in remote locations, we have very little use for hotel points other than what has been mentioned above. Mostly we use them at airports before or after a flight. After several devaluations were announced, I knew I had to spend these points asap before they were totally worthless.

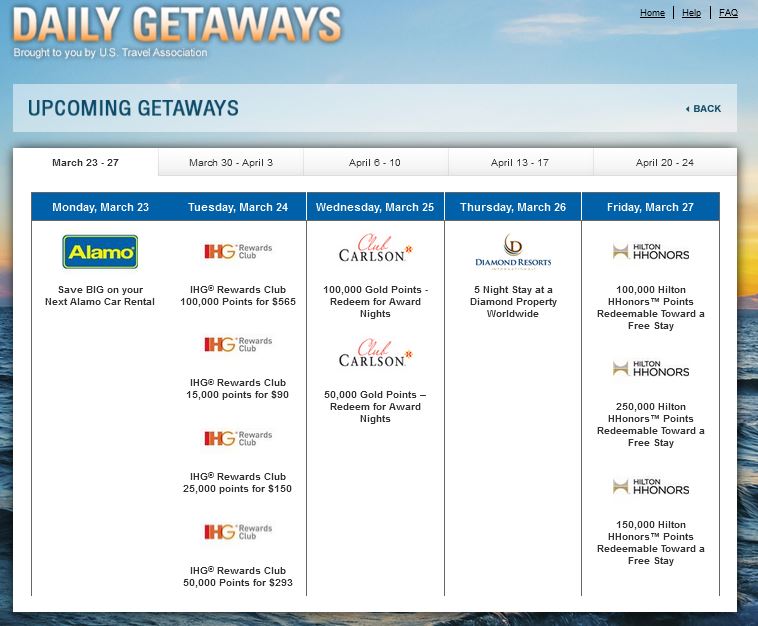

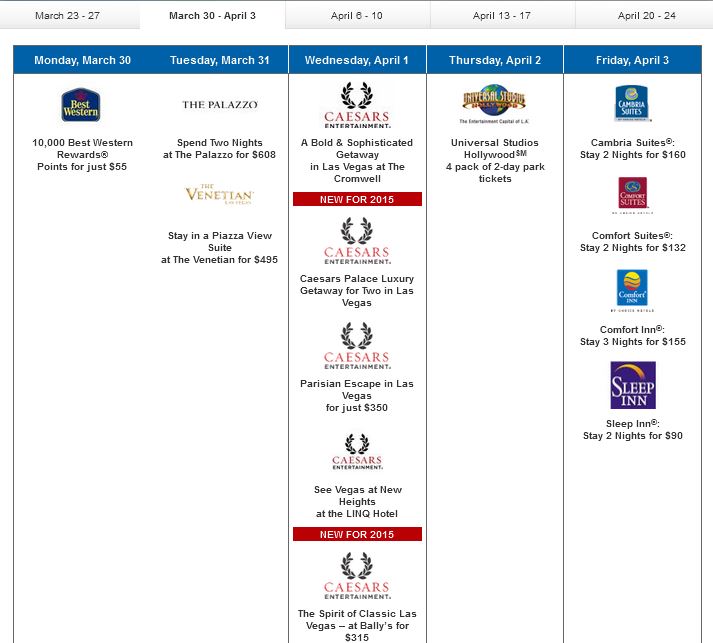

2014 was my year for massive burning of hotel points. 100,000’s of Club Carlson were used as above. 100,000’s of IHG Rewards were burned in French Polynesia, Israel & Africa (actually this includes the annual Chase free night certificate). I used E-Rewards to top up Hilton just enough to get us 2 free nights in Mauritius and used Choice for one night pre-cruise at the Comfort Inn Diana in Venice, then sent the remaining points to United Airlines. Now here I am at the end of 2014 and the only hotel points I have left are about 25k in Club Carlson, 30k in IHG and about 12k in La Quinta from the Facebook game last year.

MAKING THE DECISION – WHO STAYS AND WHO GOES

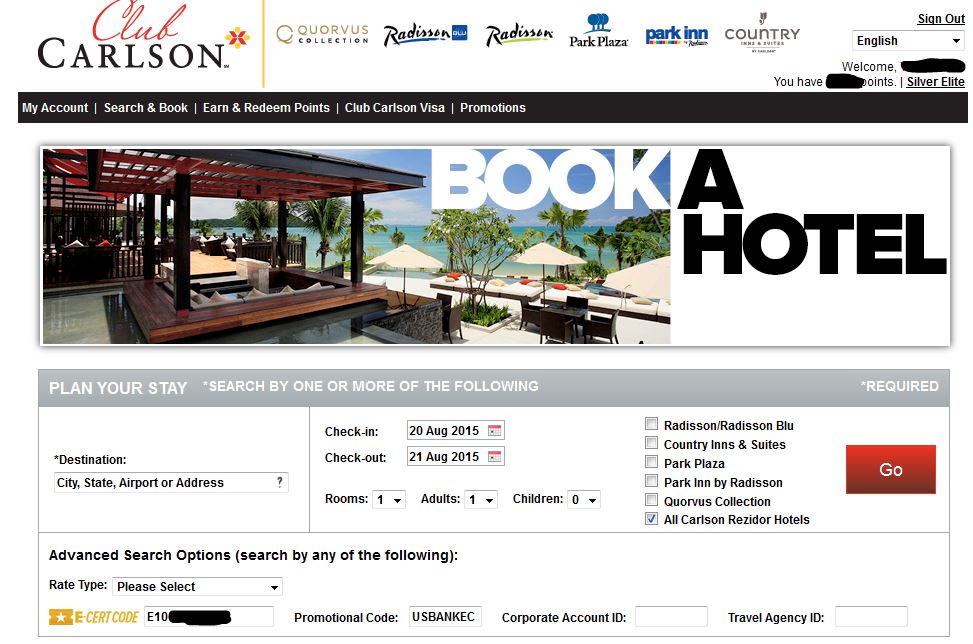

Looking to 2015 and beyond, I now need to assess which hotel programs (if any) I will keep. I also need to know which hotel credit cards to get rid of. To do this, I used two maps made by Drew at Travel is Free. One for Club Carlson and one for IHG.

1. IHG is a keeper for the long run. The $49 for the card which gets a free night certificate is easily worth it. In any given year, we would need at least one stay at an airport hotel and IHG serves this market well. They have properties at most of the gateway cities we would be transiting to get to eco-lodges.

2. La Quinta is easy, there is one near my Mom’s house so I know what to do with them.

3. Hilton, Marriott, Hyatt, Choice, Best Western & Wyndham are either zeroed out or have a few orphaned points (less than 1000) and we won’t be needing any of these chains for the foreseeable future.

4. SPG is more valuable for airline transfers into otherwise difficult programs such as Flying Blue. I have the credit card because of the bonus but never use it because they have no category bonuses and they charge forex fees. Plus I can use my Aussie Amex to transfer into SPG so this card can go, but I will keep my SPG account active.

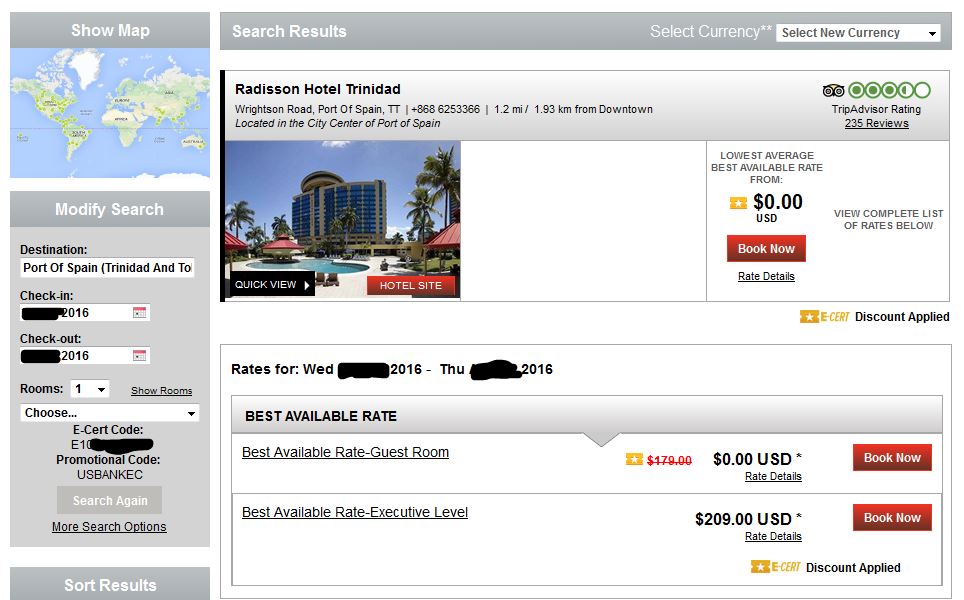

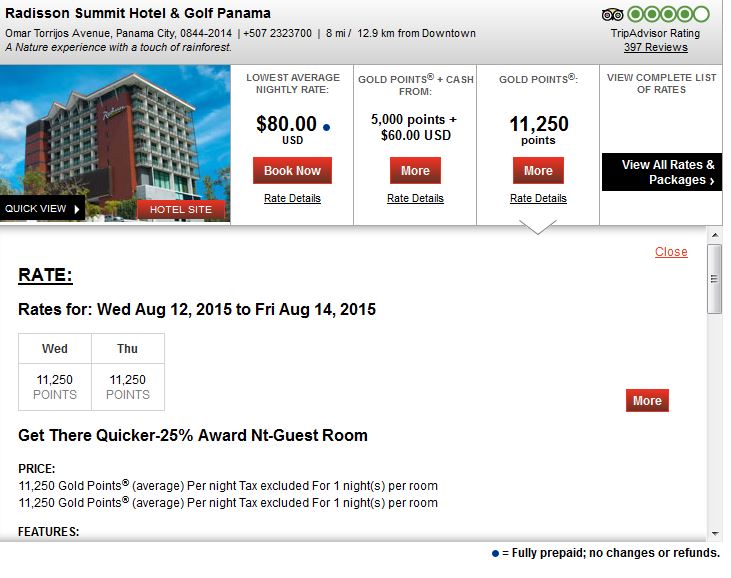

5. My Club Carlson Visa also comes up for renewal next month – $50 since I only have the basic card (silver status) not the more expensive one that gets gold status. Using Drew’s maps, I can easily see that the only places I want to go to that have Club Carlson properties are Puerto Rico and Trinidad. I can see spending 2 nights at the Puerto Rico one as it is within easy driving distance of El Yunque National Forest and the value of 2 nights is easily more than the $50 fee. This trip is planned for mid 2016 so will be bookable in Oct this year. In Trinidad, a trip planned for 2018, I would much prefer to stay at the Asa Wright Centre’s Lodge for the superb birding, even though it costs more than paying the card fee for 2 more years would cost. So the verdict is keep this card one more year, then cancel it.

SO WHERE WILL I BE BOOKING HOTELS?

By the end of next year, I will be down to only one program – IHG for the annual Chase certificate. SPG doesn’t count as it will be used for airline miles, not hotels. The best thing for me to do moving forward is use the hotel booking engines that GIVE airline miles, not COST hotel points. No more being stuck at inconvenient locations just to get a free night! On the plus side, many eco-lodges also can be booked with these engines.

POINTSHOUND – I use it for AA or Flying Blue miles. Has a wider variety of hotels than Rocketmiles and cheaper options. Using my referral link gets us both 250-1000 miles depending on what promo they are running.

ROCKETMILES – larger miles payouts but limited selection and sometimes hotels cost more so check carefully. Good for United or Flying Blue miles. Using my referral link gets us both a 1000 miles bonus.

HOTELS.COM – used if I would rather get 10 nights for one free night (value is average expenditure for the 10 paid nights). For example if we have 5 nights at a $150 hotel, 3 nights at a $50 hotel and 2 nights at a $100 hotel the total we spent for the 10 nights is $1100. The average for the 10 nights is $110 so that is the maximum value of my free night. It’s best to get as close as possible to that maximum value as you don’t get any left over value. If you choose a $125 hotel you pay the difference of $15. If you choose a $95 hotel, you forfeit the balance of the free night value of $15. You can always maximize by booking a larger/better room or a bed & breakfast rate. Sometimes they have good 5x bonuses in the Chase Ultimate Rewards Mall or Shop with Chase as they call it now. I haven’t seen a referral program for this company.

BOTTOM LINE

Having a good idea of where you want to travel in the next few years or even having a bucket list of ALL the places you want to go if you either get the miles or win the lottery helps you make wise choices in which hotel programs (if any) to participate in.